Minimum Investment

$100,000

Target Hold

72 months

Annualized Returns

17.00%

100% Funded

Project Summary

Overview

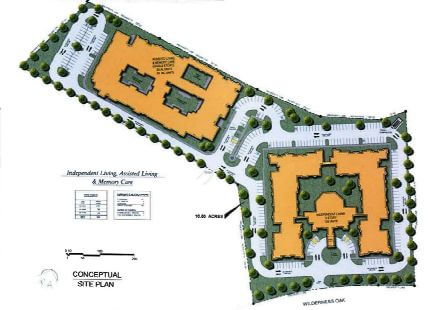

This is a master-planned Senior Living Campus comprised of Independent, Assisted, and Memory Care Units. Specifically, there will be 150 Independent, 50 Assisted, and 24 Memory Care Units. The overall site will be +/- 10 acres.

The total cost of the project is estimated to be $34.3 million. The capital structure will have an 80%/20% debt to equity ratio. Thus, the debt will be $27.473 million, and the equity will be $6.868 million. The project will be owned by a single asset, special purpose entity.

A limited partner (L/P) is being sought to provide 90% of the required equity, thus $6.181 million. The general partner will provide the remaining 10%, or $686 thousand. For this investment, the L/P will receive a preferred return of 10%, and 50% of the net sale value of the project. To provide a funding mechanism for these returns, the project will allocate 50% of the net annual operating cashflows (after debt service), as well as 50% of the net sale value of the property. They will be applied first to any outstanding preferred return due, and second to return of principal.

Forecasted timing and characteristics are as follows:

- The forecasted IRR for the L/P is 27%. This is based on the assumption that the project is sold after 5 years of operations, or 6 years total investment horizon.

- On an investment of $6.1 million, the total forecasted cashflows to the L/P is $25.9 million. This includes the preferred return (10%), return of principal, and 50% of the net sale value of the property.

- The L/P is forecasted to begin to receive cashflow in year 2 of operations, with all of the 10% preferred return being paid up in year 4 of operations. Year 5 brings the return of principal and 50% of the net sale value of the property. Please refer to the schedule of Equity Cashflows on the following pages.

- The timing and amount of all cashflows to the L/P are totally dependent on the underlying cashflows of the project.

Wilderness Oaks will consist of:

- 135 Independent Living units

- 50 Assisted Living beds

- 24 Memory Care Units

Estimated Development Budget

- Debt: $27,473,600

- Equity: $6,868,400

- Total Budget: $34,342,000

Amenities & Support:

- Heated swimming pool

- Private dining room

- Fitness / Wellness center

- Activities room

- Spa

- Card & game room

- Program activities

- Beauty salon / barber

- Movie theater

- Business office

- Community dining